- Home

- Studies and research

- Convictions immobilières Europe août 2021

Real Estate Convictions Europe : 2nd quarter 2021

The pandemic has killed over 4 million people in the last 18 months, but the Delta variant has made great strides across the planet, since it is highly contagious. Countries or regions with too low vaccination provision may be quickly forced to introduce further restrictive measures that pose significant risks to their recovery.

The upturn in activity (+6.2% in 2021 and +4.6% in 2022) will be possible as long as vaccination campaigns are intensified on a global scale in order to eliminate the health risks that the variants may generate. After a difficult start due to delivery delays and national vaccination campaigns deemed too slow, the European Commission will finally have succeeded in ensuring that 380 million doses of vaccines (first and/or second doses) are administered in the European Union.

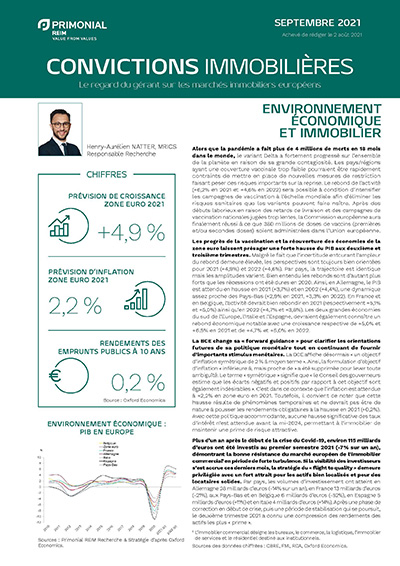

Progress with vaccination and the reopening of Eurozone economies point to a sharp rise in GDP in the second and third quarters. Although there is still a high degree of uncertainty over the size of the rebound, the outlook is still positive for 2021 (+4.9%) and 2022 (+4.6%). In the different countries, the path is the same, but the amplitude varies. Needless to say, the harder the recession was in 2020, the stronger the rebound. Thus, in Germany, GDP is expected to grow in 2021 (+3.7%) and in 2022 (+4.4%), a movement quite similar to that of the Netherlands (+2.9% in 2021, +3.3% in 2022). In France and Belgium, activity should bounce back well in 2021 (+5.1% and +5.0% respectively) and in 2022 (+4.7% and +3.8%). The two major south European economies, Italy and Spain, should also experience a notable economic rebound with respective growth of +5.0% and +6.5% in 2021 and +4.7 % and +6.0% in 2022.

The ECB is changing its «forward guidance» to clarify the future directions of its monetary policy while continuing to provide a significant monetary stimulus. The ECB is now posting «a symmetrical inflation target of 2% in the medium term». The inflation target wording «less than but close to» has thus been discarded so as to remove any ambiguity. The term «symmetrical» means that «the Governing Council considers that negative and positive deviations from that target are equally undesirable». This is the context in which Eurozone inflation is expected to be +2.2% in 2021. However, it should be noted that this increase is the result of temporary phenomena and should not be such as to push bond yields up in 2021 (+0,2%). Given this accommodating policy, no significant rise in interest rates is expected before mid-2024, allowing real estate to maintain an attractive risk premium.

More than a year after the start of the Covid-19 crisis, some 115 billion euros were invested in the first half of 2021 (-7% over a year), which demonstrates the resilience of the European commercial real-estate market1 in times of severe turbulence. While investor visibility has increased in recent months, the «flight to quality» strategy is still in favour, involving the strong appeal of well-located assets and established tenants. Investment in the various countries reached 28 billion euros in Germany (-14% over a year), in France 13 billion euros (-21%), in the Netherlands and Belgium 6 billion euros (-52%), in Spain 5 billion euros (+11%) and in Italy 4 billion euros (+14%). After a corrective phase at the start of the crisis and then a period of stabilisation that still continues, the second quarter of 2021 saw a fall in the returns of the supremely prime assets.

1 Commercial real estate refers to office, retail, logistics, service and residential real estate for institutional investors

Sources for figures: CBRE, FMI, RCA, Oxford Economics.

The team

Henry-Aurélien Natter joined Praemia REIM as Research Manager in January 2018. He has the mission of developing the analyses of the Research & Strategy Department on the real estate markets, the economy and capital in France and in Europe.

Henry-Aurélien Natter began his career at Les Echos Etudes (formerly Eurostaf), then at C&W (formerly DTZ), and lastly at BNP PRE, where he acquired solid and varied experience in real estate research, strategy and finance. He is qualified with an AES degree in Business Management, a Masters Decree in management and SME management, and an International Master in commerce and marketing.

You may also like

- Market review

Real Estate Convictions : Q4 2024

The continued reduction in ECB interest rates, the level of savings amongst Europeans and the recovery of the real estate markets between 2022 and 2024 all point to the potential for improvement and a rebound in the sector.

- Market review

Real Estate Convictions : Q3 2024

In October 2024, the ECB announced its third consecutive rate cut to ease its restrictive monetary policy, and we believe that a new momentum has opened up for the European real estate market. Indeed, this quarter we have seen a thaw in certain real estate indicators.

- Market review

Real estate convictions : 1st quarter 2024

For now, European real estate professionals have been cautious and are watching for the tipping point that could occur with the announcement of the first change in direction by the ECB.

et Firefox

et Firefox